getaguid.online

Overview

Whens The Best Time To Invest In Stocks

A majority of the market's best days have occurred during a bear market or during the first two months of a bull market when it's often too early to tell a new. One popular way to invest in the stock market is to utilize the dollar-cost averaging strategy. Dollar-cost averaging works by investing a set amount of money. Stock investment isn't about timing but about time. Timing doesn't matter if you're willing to let it sit for at least 10 to 15 years, and the. Generally speaking, the most active time of the day for stock trading is the first and last hours of the trading session. In theory, buying and selling at these. The best time of day to buy stocks is usually in the morning, shortly after the market opens. Mondays and Fridays tend to be good days to trade stocks. Why You Shouldn't Time The Stock Market “Timing the market” involves buying stocks at a low and selling quickly once they rise. While some profit from this. The time you're invested in the market is more important than investment timing. The longer you invest, the more you improve your chances of a positive. Rather than trying to time the market, it might be better to focus on time in the market. Most investments are described as a medium to long-term commitment. Investors learning how to invest in the stock market might ask when to invest. Knowing when to invest, however, isn't as important as how long you stay invested. A majority of the market's best days have occurred during a bear market or during the first two months of a bull market when it's often too early to tell a new. One popular way to invest in the stock market is to utilize the dollar-cost averaging strategy. Dollar-cost averaging works by investing a set amount of money. Stock investment isn't about timing but about time. Timing doesn't matter if you're willing to let it sit for at least 10 to 15 years, and the. Generally speaking, the most active time of the day for stock trading is the first and last hours of the trading session. In theory, buying and selling at these. The best time of day to buy stocks is usually in the morning, shortly after the market opens. Mondays and Fridays tend to be good days to trade stocks. Why You Shouldn't Time The Stock Market “Timing the market” involves buying stocks at a low and selling quickly once they rise. While some profit from this. The time you're invested in the market is more important than investment timing. The longer you invest, the more you improve your chances of a positive. Rather than trying to time the market, it might be better to focus on time in the market. Most investments are described as a medium to long-term commitment. Investors learning how to invest in the stock market might ask when to invest. Knowing when to invest, however, isn't as important as how long you stay invested.

While there are periods of time when the economy and markets slow down, over time improvements in productivity and innovation have continued to propel markets. The best time to buy stocks is when the share prices of a given stock are at a low. There is always a chance that they will drop even further, but buying at a. Historical market trends indicate the returns of stocks and bonds exceed returns of cash investments and bonds. When markets are going up, putting your money to. Thinking about buying the dip? When talking about stocks or any financial asset, a dip is a drop in price. You might buy the dip if you think the price will. Best time to invest is at the time of the fall. Now stocks are at all time high so wait for sometime for market to correct. Now you can find. Time in the market beats timing the market. The best moment to buy stocks is always yesterday. When you're setting up a financial plan, take time to think through your life goals, the milestones you want to achieve and your priorities. Otherwise, you. The best time of day to buy and sell stocks is 3 – 4 pm EST. Q. What is the best day of the week to buy and trade stocks? A. Even when the market is volatile, it usually pays to keep investing. However, it would be best if you double-checked that you have a sufficient emergency. If your time horizon is between two to 10 years, a mix of stocks and more conservative investments such as bonds may be best; and if it's less than two years. So when a bear market or a recession arrives, these stocks can lose a lot of value very quickly. It's like their sudden popularity disappears in an instant. By making regular investments with the same amount of money each time, you will buy more of an investment when its price is low and less of the investment when. What about volatility in the markets? “When it comes to investing in volatile asset classes like equities, your time horizon is incredibly important. It is. Unlike with a traditional savings account or ISA, you generally don't receive a guaranteed rate of return when you invest your money. Instead, your savings can. We expect solid returns from both stocks and bonds over the next six to 12 months. Once again, a multi-asset investment portfolio can work in different economic. In my opinion I would say no. · The even bigger issue gets more into behavioral finance. · In the end, over the long-term, the key is not when you invest, as much. When you're setting up a financial plan, take time to think through your life goals, the milestones you want to achieve and your priorities. Otherwise, you. By making regular investments with the same amount of money each time, you will buy more of an investment when its price is low and less of the investment when. This may come as no surprise for you, but there's no right or wrong time to buy shares. In fact, it's not so much about when you buy stocks and shares, but. The best day of the week to buy shares. Mondays. Kind of. According to Peter Lynch's book One Up on Wall Street (), it's because when companies have bad.

Margin Call Meaning In Stock Market

:max_bytes(150000):strip_icc()/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)

How margin calls work. The brokerage issues a margin call in the stock market when an investor's account equity falls below a certain level. If the investor. To grasp what a margin call is, you first need to understand margin accounts. A margin account lets investors borrow money from a broker to purchase stocks or. A margin call is a broker demand requiring the customer to top up their account, either by injecting more cash or selling part of the security. Margin trading increases your level of market risk. Your downside is not limited to the collateral value in your margin account. Schwab may initiate the sale of. A margin call is when it goes down so much that you lost all your money and the bank takes what's left. A margin call is triggered when an investor trading on margin has an account value below the minimum requirement. A margin account is a method for investors to. A margin call is the broker's demand that an investor deposit additional money or securities so that the account is brought up to the minimum value. If the equity in your account drops below the minimum margin requirement set by your brokerage, it could trigger a margin call. Market depreciation is usually. You'll get this call when your equity falls below the New York Stock Exchange (NYSE) requirement, currently at 25%. If you get an exchange call, your account. How margin calls work. The brokerage issues a margin call in the stock market when an investor's account equity falls below a certain level. If the investor. To grasp what a margin call is, you first need to understand margin accounts. A margin account lets investors borrow money from a broker to purchase stocks or. A margin call is a broker demand requiring the customer to top up their account, either by injecting more cash or selling part of the security. Margin trading increases your level of market risk. Your downside is not limited to the collateral value in your margin account. Schwab may initiate the sale of. A margin call is when it goes down so much that you lost all your money and the bank takes what's left. A margin call is triggered when an investor trading on margin has an account value below the minimum requirement. A margin account is a method for investors to. A margin call is the broker's demand that an investor deposit additional money or securities so that the account is brought up to the minimum value. If the equity in your account drops below the minimum margin requirement set by your brokerage, it could trigger a margin call. Market depreciation is usually. You'll get this call when your equity falls below the New York Stock Exchange (NYSE) requirement, currently at 25%. If you get an exchange call, your account.

Margin calls triggered by rising interest rates could force a wholesale dumping of stocks. From New York Post. These examples are from corpora and from sources. An investor will need to sell positions or deposit funds or securities to meet the margin call. If the investor fails to cover the margin call within 3 trading. A margin call is a request by a broker for an investor to deposit funds into their investment account to keep all their positions open. Most brokerages require a maintenance margin of 25%, which is to say that the equity value – the amount that the trader put up for the shares, must be at least. A margin call is the kind of call no investor or trader wants to get. When you invest or trade in a margin account, you borrow money to buy or sell stocks. 5How can you avoid a Margin Call? 6Conclusion. Any individual who has engaged in trading or investing in the stock market recognises the. You will be placed on margin call if the equity in your account falls below % of your maintenance margin – at this point, you will be notified by email. If. Margin call is when the equity on your account—the total capital you have deposited plus or minus any profits or losses—drops below your margin requirement. The principal story takes place over a hour period at a large Wall Street investment bank during the initial stages of the – financial crisis. It. A margin call is when you're required to deposit more funds to keep the amount of your investments above the margin. The upside of buying stocks on margin is. In the event of a missed margin call deadline, the brokerage decides which stocks or investments to liquidate to bring the account back to the maintenance level. A margin call occurs when investors' investment capital in a margin requirement drops below the minimum level specified by the broker. The use of cross-guarantees to meet any day-trading margin requirements is prohibited. Why Do I Have to Maintain Minimum Equity of $25,? Day trading can be. A margin maintenance call is when your portfolio value (minus any crypto positions) falls below your margin maintenance requirement. A margin call is triggered when an investor trading on margin has an account value below the minimum requirement. A margin account is a method for investors to. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more. A margin call occurs when an investor must contribute cash or sell investments to uphold a specific equity level in their margin account. • Margin trading. % margin call means that someone is borrowing % of their money to invest. This is the riskiest margin investment because if the market dips the investor. Margin call is the term for when you no longer have sufficient funds in your account to keep a leveraged position open.

What Is The Maximum Mortgage I Can Get

Your mortgage interest rate can either be Fixed for the term or Variable Get in Touch. - West Pender Street Vancouver, BC V6E 4B1. hello. You can use this maximum mortgage calculator to figure out how much money you can borrow; when thinking about buying a new home. The calculator provides the. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. How much of a mortgage loan can you comfortably afford? Use Carter Bank's Maximum Mortgage Calculator to estimate your monthly payment and get an idea. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. So you should be able to borrow up to times or even times your annual income. Looking for tips on how to pay off your mortgage? Watch our video below. Use this calculator to determine your maximum mortgage and how different interest rates affect how much you can borrow. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. The absolute lowest your own loan limit can be is 65% of the national conforming loan limit, which for a 1-unit property in is $, Your mortgage interest rate can either be Fixed for the term or Variable Get in Touch. - West Pender Street Vancouver, BC V6E 4B1. hello. You can use this maximum mortgage calculator to figure out how much money you can borrow; when thinking about buying a new home. The calculator provides the. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. How much of a mortgage loan can you comfortably afford? Use Carter Bank's Maximum Mortgage Calculator to estimate your monthly payment and get an idea. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. So you should be able to borrow up to times or even times your annual income. Looking for tips on how to pay off your mortgage? Watch our video below. Use this calculator to determine your maximum mortgage and how different interest rates affect how much you can borrow. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. The absolute lowest your own loan limit can be is 65% of the national conforming loan limit, which for a 1-unit property in is $,

Once you entered your values, click on “Calculate” to get your Borrowing Capacity. Down payment: 20, $. Maximum mortgage amount: , $. Monthly. How Do Maximum Mortgage Calculations Work? As we've explained, a lender will take your annual earnings and multiply them to reach an indicative maximum. For. Most banks will use k (50% of your wage) as the upper limit. That leaves you k to pay for all other expenses such as food, transportation. Maximum Baseline Loan Amount for ; 1, $,, $1,, ; 2, $,, $1,, ; 3, $1,,, $1,, ; 4, $1,,, $2,, Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. This video shows you how your mortgage payment should fit comfortably into your lifestyle. Learn more about how much mortgage you can afford. Find a down. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. How much home can you afford? This calculator factors in your total earnings and debts to give you a maximum affordable monthly housing cost. Calculator Results. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. How much can you afford? What is your maximum mortgage? That largely depends on your income and current monthly debt payments. This calculator collects these. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. Where do you want to live? ; Less than $,, 5% of the purchase price ; $, to $,, 5% of the first $, of the purchase price 10% for the. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. The amount you could borrow is based on your income increased by a multiplier. Lenders traditionally offer an amount between four and five times your income. First time buyers maximum mortgage level is 4 times your gross annual income with the mortgage capped at 90% of the purchase price. To evaluate your maximum borrowing capacity, calculations are based on your down payment, the maximum mortgage debt ratios (32% for the GDSR note and 40% for. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Determine your mortgage affordability range and see how much you can borrow based on factors including income, debt, monthly expenses, lifestyle, savings, your. Mortgage Type: The type of mortgage you choose can have a dramatic impact on If the year mortgage puts you uncomfortably close to your maximum.

Best Way To Use Points For Travel

Transfer your points to fly in business or first class The best way to receive the most value for your American Express Membership Rewards points is to. Get the Right Credit Cards. Credit cards are the single most lucrative source of points and miles out there. Credit cards are offering huge signup bonuses of up. Redeem your rewards wisely. At the risk of stating the obvious, redeem airline miles for flights and hotel points for hotel stays. If your card offers. You can use your points for more than just flights. With More Rewards, Rapid Rewards Members can use their points for merchandise, hotel stays, gift cards, and. The second way you can redeem those points when it's a bank specific credit card is you can book through their own travel portal and use the points like cash. A: Amex points are the best when you transfer to airlines. Chase points are good for transferring to both airlines and hotels booking through Chase travel. Credit card rewards, specifically travel rewards, are an extremely useful resource to help you save money on your travel expenses. They can lead to nearly free. Using TrueBlue points is easy. Redeem them on JetBlue flights and flight + hotel packages—based on the current price for that trip and not some sky-high. 1. HAVE A CREDIT CARD STRATEGY IN MIND · 2. CHOOSE A CARD WITH TRANSFERABLE REWARDS · 3. TAKE ADVANTAGE OF AIRLINE ALLIANCES · 4. EARN REWARDS FOR THINGS YOU'RE. Transfer your points to fly in business or first class The best way to receive the most value for your American Express Membership Rewards points is to. Get the Right Credit Cards. Credit cards are the single most lucrative source of points and miles out there. Credit cards are offering huge signup bonuses of up. Redeem your rewards wisely. At the risk of stating the obvious, redeem airline miles for flights and hotel points for hotel stays. If your card offers. You can use your points for more than just flights. With More Rewards, Rapid Rewards Members can use their points for merchandise, hotel stays, gift cards, and. The second way you can redeem those points when it's a bank specific credit card is you can book through their own travel portal and use the points like cash. A: Amex points are the best when you transfer to airlines. Chase points are good for transferring to both airlines and hotels booking through Chase travel. Credit card rewards, specifically travel rewards, are an extremely useful resource to help you save money on your travel expenses. They can lead to nearly free. Using TrueBlue points is easy. Redeem them on JetBlue flights and flight + hotel packages—based on the current price for that trip and not some sky-high. 1. HAVE A CREDIT CARD STRATEGY IN MIND · 2. CHOOSE A CARD WITH TRANSFERABLE REWARDS · 3. TAKE ADVANTAGE OF AIRLINE ALLIANCES · 4. EARN REWARDS FOR THINGS YOU'RE.

Cardmembers can also redeem earned miles for a statement credit when they use their card to buy United flights. Book award travel. If you don't have enough. Earn flexible points currencies with credit cards · Understand airline partnerships & alliances · Redeem miles for first & business class · Learn how & where to. Using TrueBlue points is easy. Redeem them on JetBlue flights and flight + hotel packages—based on the current price for that trip and not some sky-high. More Ways to Redeem Miles Your miles are good for much more than just flights. Explore all the ways you can redeem your miles. Use miles to cover fees for. Redeem through the rewards program's travel portal · Log in to your online account. · Visit the travel portal and start shopping for the trip you want to take. Transfer your points to the airline partner with the best exchange rate (OK, where can I find an updated list?) · Each airline has a unique way. Get On Board with Points · Cruise. Get On Board. Use (or earn) points when you book through our Cruise With Points program. Learn More Opens a new window. That you can rack up free nights and free flights through frequent flier miles speaks to the value of travel rewards programs. Find out which credit cards. Shortly after returning from our honeymoon, I started researching how to use the new points I earned by signing up for my first travel credit card. I ended up. Traveling on point(s) involves earning credit card points and using those points to travel the world for free or nearly free. This article teaches you how to. Discover how to use points and miles to maximize your travel rewards and save big on your next trip. Redeem your airline and credit card rewards for better flights for fewer points. Zak had only earned a handful of points so far and wasn't sure how he could. Book travel through the Chase portal: This is where Ultimate Rewards points are most valuable. You can book hotels, airfare and vacations at cents per point. The idea is that you sign up for a credit card, complete the minimum spending requirement, get the points, redeem the points for flights and/or hotel nights, go. 3. Redeem Chase points for Europe. For folks in the Midwest and East Coast, if you're okay flying economy, it's almost certainly going to be a better use of. At checkout, select either "Use Only Points" or "Use Points + Card" then apply points to your booking. Book Trip. Step 3. Once booked. But travel is expensive, and that can threaten your financial freedom and security in the future. The good news? It doesn't have to. Over the last two years. At checkout, select either "Use Only Points" or "Use Points + Card" then apply points to your booking. Book Trip. Step 3. Once booked. But travel is expensive, and that can threaten your financial freedom and security in the future. The good news? It doesn't have to. Over the last two years. Most of the best credit cards for travel have an annual fee, but earning valuable points and miles more than makes up for it in many cases. Also, some cards.

How Much Whole Life Insurance Should I Have

In order to figure out the insurance coverage that works best for your particular situation, you should consider factors like your age, your salary, how much. You can pay whole life insurance policies forever or over 10 to 20 years — it's your choice. But your monthly premiums will increase dramatically should you. Whole life insurance rates by age and sex ; Coverage amount: $35,Male: $ | Female: $ · Coverage amount: $35,Male: $ | Female: $ Another way to estimate your life insurance needs is to multiply your current income by This simple method can give you a number to start with, but you may. The beneficiary shouldn't have to pay any income taxes on the death benefit. We recommend you speak with a tax professional to see how you can lower your tax. The policy you purchase should have a death benefit of at least this amount, if you can afford it. With term life insurance, you can typically choose a coverage. A whole life insurance policy provides guaranteed death benefit to help gain lifelong protection and wealth-building cash value. Here's how to decide if. However, the investment benefits may not be worth it if you can't afford the premium payments. As mentioned earlier, premiums for whole life coverage often are. When the policy expires, you must buy another term and pay higher premiums if you still wish to have life insurance. Whole life insurance: What is whole life. In order to figure out the insurance coverage that works best for your particular situation, you should consider factors like your age, your salary, how much. You can pay whole life insurance policies forever or over 10 to 20 years — it's your choice. But your monthly premiums will increase dramatically should you. Whole life insurance rates by age and sex ; Coverage amount: $35,Male: $ | Female: $ · Coverage amount: $35,Male: $ | Female: $ Another way to estimate your life insurance needs is to multiply your current income by This simple method can give you a number to start with, but you may. The beneficiary shouldn't have to pay any income taxes on the death benefit. We recommend you speak with a tax professional to see how you can lower your tax. The policy you purchase should have a death benefit of at least this amount, if you can afford it. With term life insurance, you can typically choose a coverage. A whole life insurance policy provides guaranteed death benefit to help gain lifelong protection and wealth-building cash value. Here's how to decide if. However, the investment benefits may not be worth it if you can't afford the premium payments. As mentioned earlier, premiums for whole life coverage often are. When the policy expires, you must buy another term and pay higher premiums if you still wish to have life insurance. Whole life insurance: What is whole life.

Could whole life insurance be right for you? Check out how it compares to When it comes to a Nationwide whole life insurance policy, you have choices. How to apply for whole life insurance · Call to get a quote and personalize your policy. · Answer some questions about your health and lifestyle, which may also. To calculate the amount of whole life insurance you need, consider your primary reason for buying the coverage. If you are purchasing a policy to cover burial. To choose your desired coverage amount, consider how much money your family and loved ones would need — both short-term and long-term. What immediate expenses. Life Insurance Calculator. How much life insurance do I need? I was born on. / Birth Month. / Birth Year. Must be a valid date and between 18 and years of. While whole life insurance is typically more expensive than term life insurance, one of the greatest benefits of a whole life insurance policy is lifelong. k is a paltry coverage though, I suggest increasing it to at least $ 1mn. Once you have done that, get an individual term life insurance. However, the investment benefits may not be worth it if you can't afford the premium payments. As mentioned earlier, premiums for whole life coverage often are. Unlike a term policy that only offers death benefits, a whole life policy can help provide financial security in the form of cash value that you can access as. Who should have whole life insurance? Whole life insurance is a good choice for many different families and needs. You can protect your loved ones. The beneficiary shouldn't have to pay any income taxes on the death benefit. We recommend you speak with a tax professional to see how you can lower your tax. Whole life or universal life policies, if you can afford permanent coverage, can provide more financial security for your loved ones. But if you have a lot of. Whole life insurance offers permanent protection and builds cash value at a set rate. And as long as you pay required premiums on time, your benefits are. Review your annual salary: If you are using life insurance to replace your income for a loved one, you may want to multiply your annual income by the number of. Help prepare for the unexpected and build cash value with whole life insurance from State Farm. Talk to an agent today about whole life insurance quotes. whole life, you could have the chance to earn annual dividends, too.3 Your advisor will help you figure out which is best for you, and exactly how much you need. Your policy builds a cash value that grows at a guaranteed rate as long as premiums are paid on time. finacial growth icon. If you need money during your. Finally, whole life insurance policies typically have high fees and commissions, affecting the policy's cash value. How long does a whole life insurance policy. You can choose to make payments for 20 years, until you turn 65 or for the life of your policy. How to get whole life insurance. Step1.

Tax Equivalent Yield Calculator

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Eaton Vance Parametric Tax-Equivalent Yield Calculator · STEP 1: Determine your total tax rate · STEP 2: Enter pre-tax yield of an in-state municipal bond. Taxed @ Federal, Taxed @ State, AMT on Private Activity Bonds. Fully Taxable, Yes, Yes, N/A. Treasury, Yes, No, N/A. National Tax-Exempt, No, Yes, Yes. The Tax-Equivalent Yield Calculator uses the following formulas to calculate tax-equivalent yields: Out-of-State Municipal Bond Yield = In-State Muni Bond. To make an after-tax comparison of bonds with different tax treatments, use this calculator to determine their taxable-equivalent yield. Answer the questions. This calculator will estimate the tax-equivalent yield (TEY) for a municipal bond. Income generated from municipal bond coupon payments is not subject to. Tax Equivalent Yield = Tax Exempt Yield / (1 – Marginal Tax Rate) Say for example that you are considering two bonds, a taxable corporate bond that offers a. Tax Equivalent Yield Calculator. Calculate equivalent taxable yield from tax-free yield. Tax-free Yield (%). Income Tax Rate (%). Taxable Yield (%). Calculate. Understand how taxes can impact your clients' returns on bonds and how a simple calculation can help maximize outcomes. Use this calculator to determine an equivalent yield on a taxable investment. The higher your marginal tax bracket (state and federal), the higher the tax-. Eaton Vance Parametric Tax-Equivalent Yield Calculator · STEP 1: Determine your total tax rate · STEP 2: Enter pre-tax yield of an in-state municipal bond. Taxed @ Federal, Taxed @ State, AMT on Private Activity Bonds. Fully Taxable, Yes, Yes, N/A. Treasury, Yes, No, N/A. National Tax-Exempt, No, Yes, Yes. The Tax-Equivalent Yield Calculator uses the following formulas to calculate tax-equivalent yields: Out-of-State Municipal Bond Yield = In-State Muni Bond. To make an after-tax comparison of bonds with different tax treatments, use this calculator to determine their taxable-equivalent yield. Answer the questions. This calculator will estimate the tax-equivalent yield (TEY) for a municipal bond. Income generated from municipal bond coupon payments is not subject to. Tax Equivalent Yield = Tax Exempt Yield / (1 – Marginal Tax Rate) Say for example that you are considering two bonds, a taxable corporate bond that offers a. Tax Equivalent Yield Calculator. Calculate equivalent taxable yield from tax-free yield. Tax-free Yield (%). Income Tax Rate (%). Taxable Yield (%). Calculate. Understand how taxes can impact your clients' returns on bonds and how a simple calculation can help maximize outcomes. Use this calculator to determine an equivalent yield on a taxable investment. The higher your marginal tax bracket (state and federal), the higher the tax-.

Online Financial Calculator | Municipal Bond Tax Equivalent Yield - Income generated from municipal bond coupon payments are not subject to federal income. What is tax-equivalent yield? The pretax yield a taxable bond needs to possess for its yield to be equal to that of a tax-exempt bond is the. The Municipal Bond Tax Equivalent Yield Calculator has been designed to help users estimate the additional usable profit that municipal bonds generate based. Use this calculator to determine an equivalent yield on a taxable investment. The higher your marginal tax bracket (state and federal), the higher the tax-. Use this calculator to find out how much you'd have to earn from a taxable investment to equal the tax-free yield of a municipal bond investment. The book and tax-equivalent income figures for loans & leases and securities that appear on page 2 are used in selected yield ratios that appear on UBPR Pages. Free Taxable Equivalent Yield Calculator. Tax-equivalent yield is determined by taking the yield of a tax-exempt bond and dividing it by one minus an investor's federal income tax bracket. For instance. This formula is known as the taxable equivalent yield (TEY), and Morgan Stanley provides an online calculator to help you evaluate taxable and tax exempt bonds. To use the chart, find your taxable income and read across to determine your tax rate and the taxable equivalent of various tax-free yields. NatioNal. This. Use this calculator to determine the yield required by a fully taxable bond to earn the same after-tax income as a municipal bond. The tax-equivalent yield is the pretax yield that a taxable bond needs to possess for its yield to be equal to that of a tax-free municipal bond. Compare the yield of a tax-free bond to a taxable bond to see which bond has a higher applicable yield. In addition, if the bond was issued in your state of residence, you can also avoid state income taxes. Use this calculator to determine the yield required by a. Tax Equivalent Yield = Tax Exempt Yield / (1 – Marginal Tax Rate) Say for example that you are considering two bonds, a taxable corporate bond that offers a. This calculator will determine the yield that a tax-exempt bond would have to earn to be equivalent to the yield of the taxable bond. calculate whether a municipal bond offers a yield that's competitive with its taxable equivalent. The formula looks like this: Tax-Equivalent Yield = Tax. To find the pre-tax yield of an equivalent state and federal taxable investment, you'd have to do % * (%) / (%%) = %. The Taxable Equivalent Yield is the yield required from a fully taxable investment to earn the same after tax income as you would with a tax-exempt. Evaluate yields on a tax-equivalent basis, taking into account your tax liability on the interest earned from each. Tax-Equivalent Yield Calculator. This.

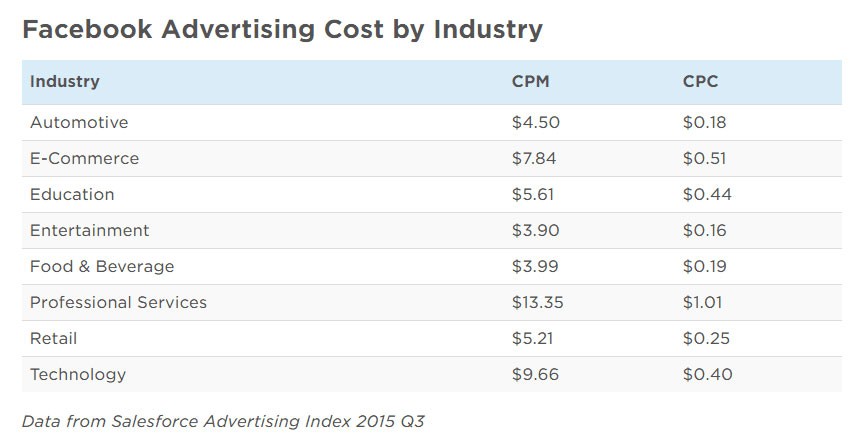

How Much Does A Facebook Ad Cost 2021

Advertising Cost in ? The cost of Facebook ads depends on your bidding How much does Facebook advertising cost for impressions? If your ad. Cost Per Click By Campaign Type · Brand Awareness: $ · Lead Generation: $ · Traffic: $ · Conversions: $ How much does Facebook marketing cost? Facebook advertising costs, on average, $ per click and $getaguid.onlinesions. Ad campaigns. WordStream's research of Facebook ads of revealed that the average CPC is $, yet the price depends on the industry. For instance, the most expensive. The level of competition for advertising space varies by industry, with some sectors seeing far higher levels of competition than others. Your ads expense will. In , the average CPC across campaign objectives and industries is $ If you break the Facebook ads average CPC down into campaign objectives, the CPC. The average Facebook ads cost-per-click in is between $ – $ However, your cost of Facebook ads depends on multiple factors. Cost per link click is calculated on Facebook by dividing your spend by the number of link clicks. For example, if your spend was $ and you got 50 links. many tools and settings to help control your Facebook ad costs. You can look at the cost of Facebook ads in two ways: how much you want to spend on a. Advertising Cost in ? The cost of Facebook ads depends on your bidding How much does Facebook advertising cost for impressions? If your ad. Cost Per Click By Campaign Type · Brand Awareness: $ · Lead Generation: $ · Traffic: $ · Conversions: $ How much does Facebook marketing cost? Facebook advertising costs, on average, $ per click and $getaguid.onlinesions. Ad campaigns. WordStream's research of Facebook ads of revealed that the average CPC is $, yet the price depends on the industry. For instance, the most expensive. The level of competition for advertising space varies by industry, with some sectors seeing far higher levels of competition than others. Your ads expense will. In , the average CPC across campaign objectives and industries is $ If you break the Facebook ads average CPC down into campaign objectives, the CPC. The average Facebook ads cost-per-click in is between $ – $ However, your cost of Facebook ads depends on multiple factors. Cost per link click is calculated on Facebook by dividing your spend by the number of link clicks. For example, if your spend was $ and you got 50 links. many tools and settings to help control your Facebook ad costs. You can look at the cost of Facebook ads in two ways: how much you want to spend on a.

The average CPM for Q3 is $, and the CPM costs of developed countries such as the United States, South Korea and Australia have exceeded three times the. On average Facebook advertising costs $ per click (CPC). However, this varies between countries. For example, in the UK average cost per click is £ . Facebook allows you to monitor and adjust your budget between $ to $1,00, or more. The cost of spending on Facebook Ads depends on your business. The average cost per click of Facebook ads in Singapore is $ SGD. The average CPM is $ SGD. Ads focused on lead generation and sales average $ SGD. The average CPC for Facebook Ads has remained relatively stable, falling around 40 cents per click. The average CPC ranges from $ in to $ in You should always test new marketing channels, especially before demand drives up prices, but make sure to consider whether your business model is a good fit. Emplifis also rolled out their research results on the average CPC of Facebook ads across the world from Q2 to Q2 These statistics show that the. How Much Should a Small Business Spend on Facebook Ads? If you are a small business, you can spend a smaller budget on Facebook ads. If you are a locally-. What is the Average Cost Per Click of a Facebook Ad? A typical cost per click on Facebook varies between $ – $ However, a higher spend per click is. In , the average CPC across campaign objectives and industries is $ If you break the Facebook ads average CPC down into campaign objectives, the CPC. The average cost per thousand impressions across all industries is $ from sample data from ad accounts targeting the United States. A Facebook ad costs anywhere from a few cents to hundreds of dollars. Reach and impressions are the least expensive campaign objectives, whereas targeting. Many advertisers opt to be charged for impressions on Facebook, and the minimum daily budget you'd need to have in that case is just $1. You can certainly make. The average Facebook CPE by campaign objective ranges from $ to $ How-Much-Do-Facebook-Ads-Cost-2 Average Facebook CPE by Campaign objectives. Benchmarks are averages that can help advertisers understand if they're overpaying, and how much they should be budgeting. Of course, benchmarking is a very. The average CPC advertising price in Q3 is $, which is about $ higher than the price in Q2. Family, Strategy, and role-playing ads rank in the top. In , the average CPL for Facebook ads is estimated to be $, with a high of $ recorded in May The average CPL across all industries is $ Download our full study on the average costs of Facebook Advertising in 20and understand how your campaign is performing compared to the. There is no fixed costs for fb ads. You write the certain amount of money you can spent on your promotion and Facebook counts your estimated. What is the Average Cost Per Click of a Facebook Ad? A typical cost per click on Facebook varies between $ – $ However, a higher spend per click is.

Is It Possible To Lose 60 Pounds In 6 Months

To lose 60 pounds in 4 months, you'd need to lose an average of 3 3/4 pounds per week -- a rate that's not readily attainable even with medically supervised. Is this weight you've always carried or only gained in recent years? IMO, if you've always been in a position where you could lose 60#, it's going to be a very. Losing 60 lbs in 6 months is ambitious and may not be sustainable or healthy for everyone. Aim for a gradual and realistic weight loss of 1 to 2. 1️⃣ To lose weight you need to be in a calorie deficit. Find your calorie deficit by going to getaguid.online and typing in your age, gender, etc. I would say 60lbs in 6 months is very ambitious. That's more than 2lbs/week which would be a daily calorie deficit. Lose 60 lbs in 6 months · JM Control's Instagram profile post: “Want those lean legs? · Most people gain weight gradually and become 50 pounds overweight in 10+. HOW I LOST 60 POUNDS IN 6 MONTHS: my weight loss transformation lbs to lbs I tell you my story with PCOS and how i lost 60 pounds of. How to lose 60 pounds in 6 months eBook: JOUVERT, Leyna: getaguid.online: Kindle Store. Yes, you can lose a significant amount of weight in 6 months. Working on both your diet and exercise will help you lose weight faster. To lose 60 pounds in 4 months, you'd need to lose an average of 3 3/4 pounds per week -- a rate that's not readily attainable even with medically supervised. Is this weight you've always carried or only gained in recent years? IMO, if you've always been in a position where you could lose 60#, it's going to be a very. Losing 60 lbs in 6 months is ambitious and may not be sustainable or healthy for everyone. Aim for a gradual and realistic weight loss of 1 to 2. 1️⃣ To lose weight you need to be in a calorie deficit. Find your calorie deficit by going to getaguid.online and typing in your age, gender, etc. I would say 60lbs in 6 months is very ambitious. That's more than 2lbs/week which would be a daily calorie deficit. Lose 60 lbs in 6 months · JM Control's Instagram profile post: “Want those lean legs? · Most people gain weight gradually and become 50 pounds overweight in 10+. HOW I LOST 60 POUNDS IN 6 MONTHS: my weight loss transformation lbs to lbs I tell you my story with PCOS and how i lost 60 pounds of. How to lose 60 pounds in 6 months eBook: JOUVERT, Leyna: getaguid.online: Kindle Store. Yes, you can lose a significant amount of weight in 6 months. Working on both your diet and exercise will help you lose weight faster.

6 Months, Losing 60 Lbs in 3 Months Being And it's not just a little weight — it's a loss of 10 pounds or 5% of your body weight in six to 12 months. It can be a symptom of a serious illness, like. In the first 6 months, I lost a total of 33lbs and went from wearing a size Diet breaks allowed me to lose weight in a very sustainable way. HOW. How I Lost 60 Lbs in 6 Months On My Own Terms & With No Special Diet Plan by Laurel Handfield is the first “diet” book I have ever read that is exactly what I. With "The Ultimate Guide to Losing 60 Pounds in 6 Months: A Simple and Sustainable Approach," you will lose weight, feel great, and look fabulous in 6 months. With "The Ultimate Guide to Losing 60 Pounds in 6 Months: A Simple and Sustainable Approach," you will lose weight, feel great, and look fabulous in 6 months. But many health care providers agree that a medical evaluation is called for if you lose more than 5% of your weight in 6 to 12 months, especially if you're an. Steps for losing 60 pounds in 6 months · Progressively increasing my training. Anyone trying to lose weight needs to progressively increase their. As long as you are in a caloric deficit on a weekly basis, you WILL lose weight. 3.) Put Your Head Down for 6 Months. Losing weight takes time. Healthy Weight Loss: Aim for lbs per week, which is a sustainable and safe approach. 60 lbs in a Month = Danger Zone: This rapid weight loss. how do we drop 60 pounds in 6 months? this is totally doable. and it's going to change your life in a number of ways. of course it's nice to. HOW I LOST 60 POUNDS IN 6 MONTHS I My Weight Loss Journey I Weight Loss Tips. In this video, I explain how I lost 60 pounds in 6 months and. 1️⃣ To lose weight you need to be in a calorie deficit. Find your calorie deficit by going to getaguid.online and typing in your age, gender, etc. And it's not just a little weight — it's a loss of 10 pounds or 5% of your body weight in six to 12 months. It can be a symptom of a serious illness, like. “Three or four hours a day of just consistent, ass-kicking hard work.” That's how Chris Pratt, star of Guardians of the Galaxy, ditched 60 pounds in six months. 60+ pounds in 3 months! this is my weight loss transformation from pounds I'm down about 8 pounds in 6 weeks. · Go to channel · 9. In general, a safe and sustainable rate of weight loss is pounds per week. Using this guideline, it could take approximately weeks (or months) to. Just rambling about my weight loss journey - 6'5 ( cm) Male, 30 years old for reference. “Three or four hours a day of just consistent, ass-kicking hard work.” That's how Chris Pratt, star of Guardians of the Galaxy, ditched 60 pounds in six months. 6 Months, Losing 60 Lbs in 3 Months Being

Syncb Credit Inquiry

Absolutely, 08 Synchrony Bank functions as a debt collector. They acquire unsettled debts from creditors who have given up on collecting those amounts. Once A soft credit check, or soft inquiry, is a credit report check that does not affect an individual's credit score. A hard pull will temporarily hurt your. If the acronym “SYNCB PPC” shows up on your credit report, it is usually caused by a PayPal Credit account being acquired by a bank. If you're seeing them on your credit report you likely have an unpaid balance. Is 01 Synchrony Bank a debt collection agency? Absolutely, 01 Synchrony Bank. No new credit inquiry needed. After 12 months of responsible use, you may be Synchrony Bank reports your credit activity to the major credit bureaus. 01 Synchrony Bank is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor. A credit inquiry is a request to view your credit report. In this example, you'll see that Synchrony Bank is an underwriter for Chevron's Credit Card: SYNCB/. You are charged an inquiry that remains on your credit report for 25 months. It may or may not lower your score. Usually 5–10 points, which are. If you find mistakes on your credit report(s), contact the consumer reporting agency (CRA) marked below, which is the CRA from which we obtained your credit. Absolutely, 08 Synchrony Bank functions as a debt collector. They acquire unsettled debts from creditors who have given up on collecting those amounts. Once A soft credit check, or soft inquiry, is a credit report check that does not affect an individual's credit score. A hard pull will temporarily hurt your. If the acronym “SYNCB PPC” shows up on your credit report, it is usually caused by a PayPal Credit account being acquired by a bank. If you're seeing them on your credit report you likely have an unpaid balance. Is 01 Synchrony Bank a debt collection agency? Absolutely, 01 Synchrony Bank. No new credit inquiry needed. After 12 months of responsible use, you may be Synchrony Bank reports your credit activity to the major credit bureaus. 01 Synchrony Bank is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor. A credit inquiry is a request to view your credit report. In this example, you'll see that Synchrony Bank is an underwriter for Chevron's Credit Card: SYNCB/. You are charged an inquiry that remains on your credit report for 25 months. It may or may not lower your score. Usually 5–10 points, which are. If you find mistakes on your credit report(s), contact the consumer reporting agency (CRA) marked below, which is the CRA from which we obtained your credit.

Understand your credit reports with expert guidance and tips to improve your credit score and manage your financial future. How To Get A Free Credit Report. The 3 extra points was because my SYNCB credit card went from 37% of the Multiple Auto Loan Inquiries on Your Credit Report · May 10, May 6. original sound - Solve Credit Problem · Synchrony Bank Pay to Delete · Remove Synchrony Bank from Credit Report · Collection Bank · Synchrony Bank Debt. PayPal Credit is subject to credit approval as determined by the Lender, Synchrony Bank hard credit inquiry, which may impact your credit score. 3. For new. SYNCB/PPC stands for Synchrony Bank / Paypal Credit. If you have a Paypal account and ever applied for or used their Paypal Credit product, they would've. CALIFORNIA RESIDENTS: If you are married, you may apply for a separate account. NEW YORK RESIDENTS: A consumer credit report may be obtained in connection with. 1If you prequalify, you will have an opportunity to accept the offer and apply for credit which may impact your credit bureau score. There are several types of hard inquiries from Synchrony Bank and its credit card affiliates. Your credit report likely shows SYNCB affiliated accounts as a. for a new credit card,. Syncb Tjx On Credit Report 4 Click the Next button below the box. If you. credit card may be on. Syncb Tjx On Credit Report an. An approved Venmo Credit Card application will result in a hard credit inquiry, which may impact your credit bureau score. Synchrony Bank pursuant to a. Your Credit Report – The 5 Easiest Ways to Deal with SYNCB · Determine Your Rights · Offer a Pay-for-Delete Agreement · File a Dispute · Hire a Professional. The Synchrony Preferred World Mastercard, which is the bank's credit-building card, offering a variable APR and no rewards to individuals with fair credit . PayPal Credit is subject to credit approval as determined by the Lender, Synchrony Bank hard credit inquiry, which may impact your credit score. 3. For new. Synchrony Bank pulls almost exclusively from TransUnion. They do report payment history to all 3 of the major credit reporting agencies. New Hard Inquiries: When a credit card or loan application is submitted in your name, the financial institution will run a credit check, adding a “hard inquiry”. The above notice applies only to consumer At Home Credit Card Accounts with Synchrony Bank and does not apply to any other accounts you have with us. It. What is SYNCB/PPC on my Credit Report? Did you just look at your credit report and see SYNCB/PPC listed and have no idea what it is? Does this loan require a credit check? Will applying for Synchrony Pay Later impact my credit score? Once 01 Synchrony Bank has your debt, they might contact you through mail or phone to seek payment. Having a collections account listed on your credit report. They have wasted another 60 days of my life because of this and I have to constantly check my credit report due to the ineptitude of Synchrony Bank and their.

Liberty Home Guard Service Fee

I was given 6 months free and my rate of $/month is locked in for good. My service call fee is locked in at $ I have had them for a year. We called about our washer drain to be fixed and they gave us the run around saying our policy covers only $ of costs for the first 3 months. Landmark's service call fee ranges from $70 to $, while Liberty's fee ranges from $80 to $ Coverages. Landmark has separate menus for existing homeowners. Liberty Home Guard's customizable plans have saved homeowners across the United States millions in appliance repair and maintenance costs. Industry. Financial. For instance, I requested a quote from Liberty Home Guard for a 5,square-foot, single-family home in Raleigh, North Carolina, and found it charges an. Your service call fee from Liberty Home Guard may be as low as $65 depending on the service, but that fee can also be as high as $ per call. Unlike some. Total Home Guard. Liberty Home Guard. Plans Starting at less than $ a Day! Most Popular. GET YOUR QUOTE. Customers are reporting to BBB that they are paying up-front service fees for technician appointments, and in many cases, appointments are delayed or cancelled. However, it's worth noting that Liberty Home Guard does not charge any transfer fees for switching policy owners. A fee may apply if the policy address is. I was given 6 months free and my rate of $/month is locked in for good. My service call fee is locked in at $ I have had them for a year. We called about our washer drain to be fixed and they gave us the run around saying our policy covers only $ of costs for the first 3 months. Landmark's service call fee ranges from $70 to $, while Liberty's fee ranges from $80 to $ Coverages. Landmark has separate menus for existing homeowners. Liberty Home Guard's customizable plans have saved homeowners across the United States millions in appliance repair and maintenance costs. Industry. Financial. For instance, I requested a quote from Liberty Home Guard for a 5,square-foot, single-family home in Raleigh, North Carolina, and found it charges an. Your service call fee from Liberty Home Guard may be as low as $65 depending on the service, but that fee can also be as high as $ per call. Unlike some. Total Home Guard. Liberty Home Guard. Plans Starting at less than $ a Day! Most Popular. GET YOUR QUOTE. Customers are reporting to BBB that they are paying up-front service fees for technician appointments, and in many cases, appointments are delayed or cancelled. However, it's worth noting that Liberty Home Guard does not charge any transfer fees for switching policy owners. A fee may apply if the policy address is.

Liberty Home Guard coverage: ; Item Covered/Plan, Appliance Guard $ monthly/$ yearly, Systems Guard $ monthly/$ yearly ; Air Conditioning, –. TOTAL HOME GUARD WARRANTY · $ / 5 Years of Coverage · The Most Consumer Centric Home Warranty Provider. · The Most Consumer Centric Home Warranty Provider. Liberty Home Guard is committed to revolutionizing the home service industry by providing customers with outstanding service and cutting edge technology to. We are absolutely committed to providing our customers with the best level of service and value. We believe in pioneering and innovating in the interest of. Home Warranty Pricing ; Total Home Guard · $ a Day! ; Systems Guard · $1 a Day! ; Appliance Guard · $1 a Day! The customer had a repair that cost $, but the warranty company only paid $ Had this customer not had to go through the warranty company. Flexible Coverage Plans Starting at $1/day. Liberty Home Guard. Systems Guard. Our Systems Guard plan provides coverage over your major home systems, including. We picked The Home Service Club as a good option for California homeowners for its relatively low minimum service fees. Both the standard and professional plans. Liberty Home Guard's annual premiums are similar to those offered by other companies, although its service fee can be more expensive (up to $) depending on. Liberty Home Guard cost ; $ · $ · $ ; $ · $ · $ Three plans are available through Liberty Home Guard. Service fees range from $80 to $ Appliance Guard ($/month or $/year) covers appliances such. Plans start at less than $1 per day—and depending on the current promotion, costs can be even lower. Liberty Home Guard's service call fees range anywhere from. Introducing the Liberty Home Guard Home Warranty mobile app, your ultimate companion for seamless home warranty coverage and exceptional home service. When a contractor visits to repair or replace a covered item, Liberty Home Guard charges a $90 “per claim fee” or deductible. The total cost of your home. We called an LHG representative and confirmed that the service call fee ranges from $65 to $ per claim. Additionally, Liberty Home Guard charges extra for. Your out-of-pocket expense is nothing more than the deductible, usually $50 to $75 per service call. We can set up monthly payments if one-time payment is not. I've used 4 different home warranty companies in the last 10 years and Liberty is the absolute worst. If there was a rating of zero stars, they would get it. So. Liberty Home Guard Cost Appliances Guard, its most affordable plan, starts at $ monthly, the Systems Guard Plan from $ monthly, and the Total Home. You'll only pay a small service fee, and the repair or replacement cost is fully covered by your warranty. Benefits of a Home Warranty in Illinois! 01Land.